AB InBev CMO to become Kraft Heinz CEO; Subscriber management clashes with AdTech

In AdExchanger's daily news roundup, it mentioned mParticle's announcements of our Accelerator program as well as the launch of our real-time Profile API.

Krafty Move

Kraft Heinz CEO Bernardo Hees will leave the company at the end of July, to be replaced by the CMO of Anheuser-Busch InBev, Miguel Patricio, the CPG brand said Monday. It’s a notable change of pace for the CEO of a top consumer brand company to come up through marketing. And it speaks to investor concerns that by aggressively cutting marketing budgets, many legacy brands took short-term gains at the expense of market share with young adults. “We think this change at the helm is a good sign for investors because it demonstrates that the company is very serious about pivoting its priorities toward growth rather than just cost-cutting,” says Credit Suisse analyst Robert Moskow. More. Paul Polman stepped down as CEO of Unilever this month, and was also replaced by a marketer, Alan Jope.

Square Peg, Round Hole

Publishers that “pivot to paid” have struggled to link their digital ad stacks with their subscriber management tools, Digiday reports. Many media companies have a patchwork of vendors to facilitate the two revenue streams, and these are often not interoperable. For instance, which is responsible for sending emails: the technology for fostering reader relationships or the automated email marketing system? “Just like the tech stack in advertising evolved over time and there are some best practices that publishers subscribe to, the consumer tech stack is evolving,” according to Fran Wills, the president of the Local Media Consortium. More.

FAANGs OutThe so-called FAANG stocks – Facebook, Amazon, Apple, Netflix and Alphabet’s Google – are on a tear this year, as former consumer technology bears take another look at the sector. Those five companies plus Microsoft have gained a combined $872.5 billion in market cap so far this year, almost clearing their $945 billion losses in the fourth quarter last year, The Wall Street Journal reports. FAANG investors could lose out if US economic growth slows down, or if consumer privacy changes meaningfully reduce revenue for the biggest tech companies. But the stocks have alluring growth potential since the sell-off last year. Facebook and Alphabet are trading at 23 and 25 times their earnings, respectively, below their trading levels from 2018. Amazon is down to trading at 60 times earnings from 84 times last year, while Netflix stands at 85 times earnings versus 95 times. More.

But Wait, There’s More!

Why The Internet Could Help Small Businesses Regain Power - The Information

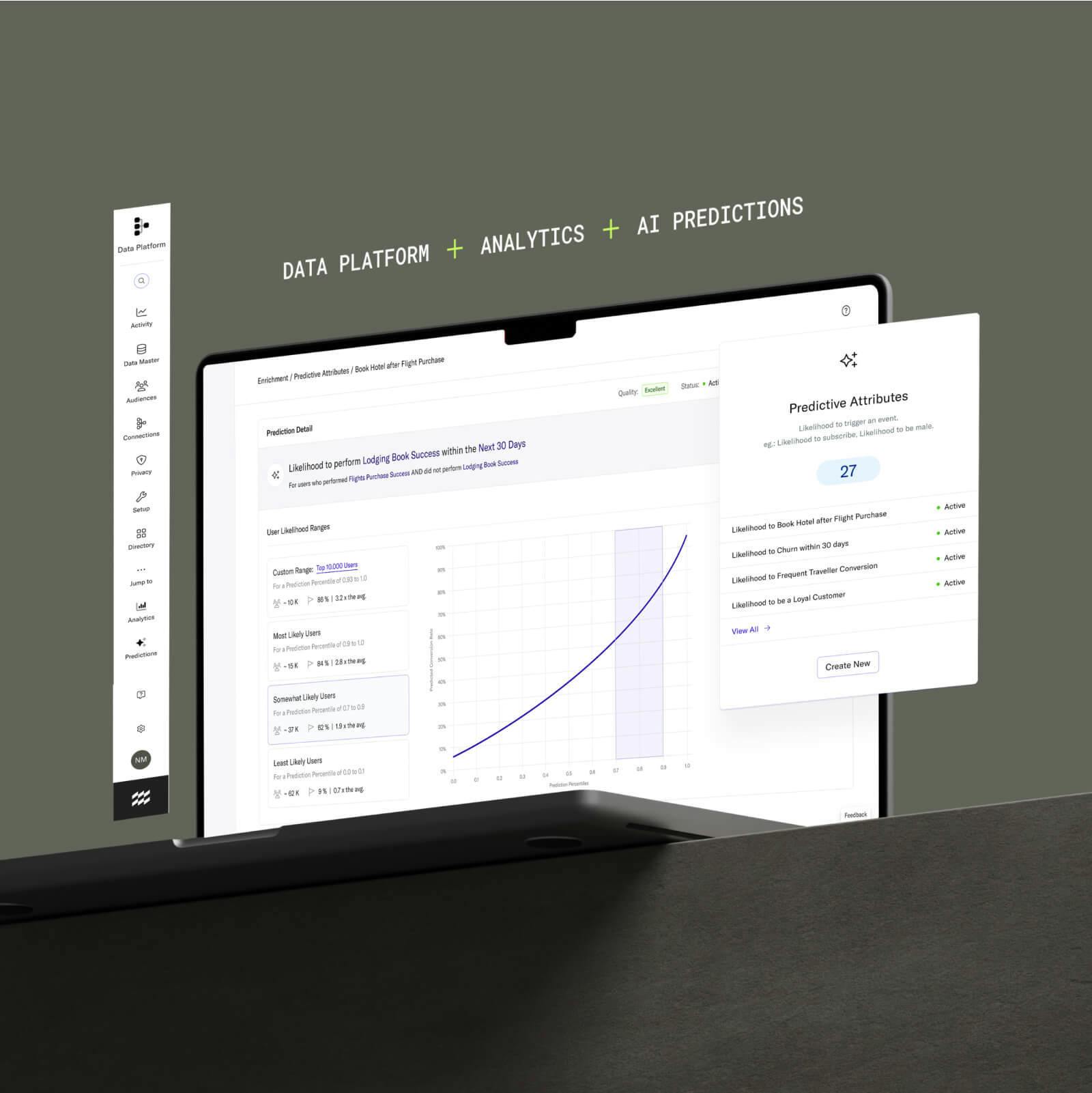

mParticle’s Plan To Fend Off Adobe And Salesforce - Business Insider

Think You’re Discreet Online? Think Again - NYT

Audioburst Raises $10M, With New Strategic Backers Dentsu And Hyundai - release

America’s Biggest Grocer Struggles With Online Ordering Upheaval - WSJ

US Trade War Delays China’s Rules Curbing Data Transfers - Financial Times