COVID's impact on the financial services industry

In times of uncertainty, financial services companies are uniquely placed to enrich people's lives. Learn more about how the coronavirus pandemic has impacted personal banking and how financial services industry leaders are adapting.

Digital banking products have been knocking at the door of the financial services customer experience for a long time. Looking back four or five decades, pioneering products such as The Bank of Scotland’s “Homelink” phone banking (1983), Microsoft Money’s personal banking software (1994), and Yodlee’s account aggregation software (2001) paved the way for the digital banking channels we have today (for an interesting visual of this evolution, check out this infographic from The Financial Brand). In recent years, advancements in mobile technology and wider digital adoption have led to digital banking becoming more prevalent, particularly among younger consumers.

When the coronavirus pandemic hit the world, however, everything in the banking world changed. Consumers that previously had not used digital banking services had to adopt them overnight, and financial institutions themselves were forced to accelerate their product roadmaps and upgrade existing digital offerings.

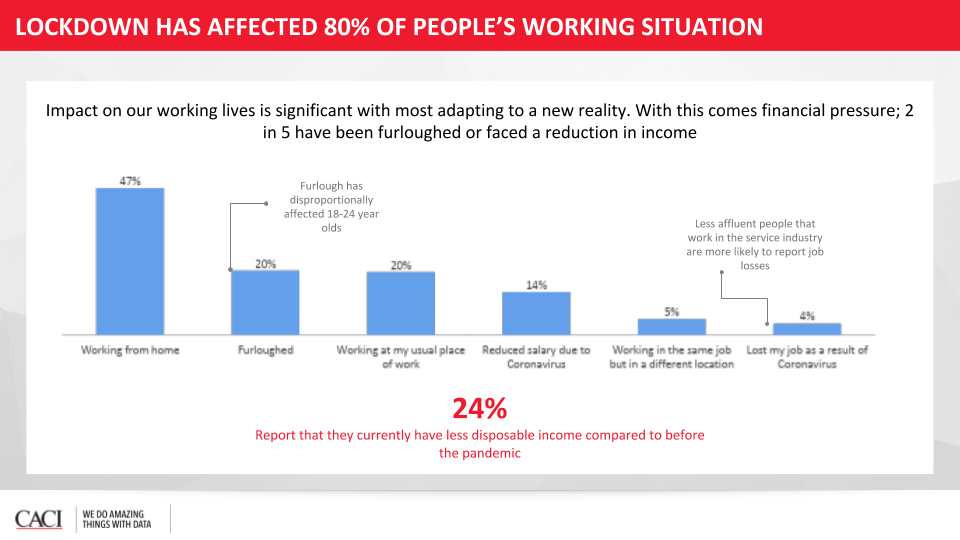

When coronavirus-related lockdowns were imposed across countries, consumer banking was impacted in two major ways. First, the economic downturn caused by the pandemic significantly impacted the disposable income and career stability of many households, resulting in changes in banking behavior. Second, the closure of bank branches led consumers to drastically change the ways they did their banking, specifically leading to adoption of digital channels. Leading consultancy CACI UK led in-depth research into how these two trends impacted consumers in the United Kingdom.

In their research, CACI found that a staggering two out of every five UK consumers have been furloughed or faced a reduction in income and that 24% of UK consumers report having less disposable income than they did before the pandemic.

Additionally, CACI found that different demographic groups had different responses to the financial stresses of the pandemic. When lockdowns were imposed, the research found that the “city sophisticates” market segment, who live in metropolitan areas and have a higher than average income, began spending more. The “striving families” segment, on the other hand, began spending less than before the lockdown period. When lockdowns began to ease, “city sophisticates” again raised their average spending, now significantly higher than pre-lockdowns levels. “Striving families,” on the other hand, returned their spending to pre-lockdown levels. When making financial decisions specifically, “city sophisticates” were more likely to switch to premium products during the lockdown, while “striving families” were more likely to shop around.

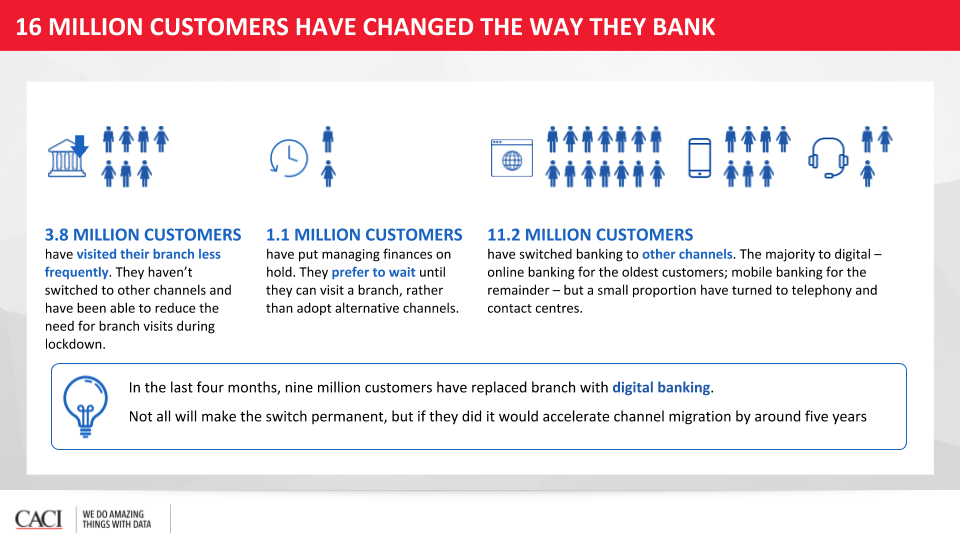

The way that consumers are banking has also changed drastically during lockdowns. CACI research found that 3.8 million UK consumers have been visiting their bank branch less frequently during the lockdown, but have not yet switched to a digital banking channel. On top of that, 1.1 million consumers have paused managing their finances completely, preferring to wait until branches return to normal availability. A staggering 11.2 million consumers, however, have switched to alternative banking channels, most commonly online banking or mobile banking. For reference, the population of the United Kingdom as of 2019 is 66.65 million.

What are industry leaders doing to adapt to these changes?

To serve their customers during this time of need, industry leaders have been forced to modify their strategies. As so many customers are adopting digital products for the first time, having a strong digital product that meets customer expectations and provides support when needed is critical to successful onboarding and retention.

Accordingly, leaders have been quick to accelerate their digital roadmaps. In an August 2020 EY report covering the pandemic’s impact on banking, one director reported that the pandemic has forced an increased internal decision-making process for anything related to digital. Regarding the launching of digital services, he described, “suddenly the impossible became possible. Solutions that used to take 18 months to deliver are now happening in 18 days.” While digital initiatives may have previously been balanced with traditional banking roadmap items, today’s digital-first customer experience has changed prioritization. CACI’s David Sealey, Director of Strategy and Growth, described that in this regard the pandemic has given focus to banking leadership, who now know that digital is the most important channel to invest in.

With the increased focus on digital banking comes new challenges. As customers begin to engage across digital touchpoints (mobile apps, websites, voice assistant, customer service) and teams adopt more and more tools, data can become siloed in disparate systems and data quality issues can arise. To deliver great digital banking experiences, product and marketing teams need access to unified, high-quality customer engagement data. TD Bank’s Miguel Navarro, VP of Voice & Emerging Platforms, when discussing the importance of customer data to delivering digital experiences, describes that “it’s all about the interoperability of data. You need to be able to pick up and shift data so that it can be turned into something actionable.”

What are industry leaders looking forward to?

The adoption of digital services has skyrocketed during the pandemic, and many believe that digital usage will remain high once the world returns back to “normal.” Considering the accelerated internal timelines for digital services, digital banking leaders will likely have a lot on their plates for quarters to come.

TD’s Miguel Navarro notes that he’s most excited about the adoption of automated voice technology. He explains that beyond increased accessibility, voice platforms are also uniquely poised to enable superior banking support. Financial decisions are highly personal, and some may hesitate to reveal the details or nuances of their financial situation over the phone, even if they’re speaking with a banking professional. Miguel suspects that automated voice support will allow customers to feel more comfortable when discussing sensitive financial topics, such as the need for debt consolidation, than they would if speaking to a human. This increased comfort can lead to more transparency, ultimately resulting in a better experience for both banks and customers. Additionally, Miguel notes that in the US, voice adoption is being bolstered by innovations in carplay technology, AI-driven voice recognition, and smartphone capabilities.

On a similar note, CACI’s David Sealey is interested in how banks can leverage customer data and AI/ML to account for personal spending habits. He describes that “banks and financial services are uniquely placed to improve people’s lives,” and that innovations in technology may make it more possible for them to do so. For example, if a customer has found themselves in excess debt, or has spending habits that make it hard for them to save money, what if they were able to log into a platform that could analyze their history and recommend a program to guide them out of their difficult situation? Or access a money management platform that uses AI to analyze your spend and strategically deposit money into a high interest saving account on the side? Using AI/ML technologies to assist their customers with their financial habits, banks have an opportunity to help individual people gain financial freedom.

To learn more, you can watch the full conversation with TD Bank’s Miguel Navarro and CACI’s David Sealey here.