Deliver more responsible experiences and comply with Gambling Commission regulations

New regulations have been introduced that govern how gaming operators can manage and protect their high value customers. Complying with these regulations requires a fundamental shift in the way player data is collected, managed, and used. Here are five steps you can follow to support compliance.

In September 2020, the UK Gambling Commission announced that they would be bringing in new regulations around how gaming operators managed and protected their high value customers.

While these regulations are being introduced to direct operators to take the necessary steps to ensure that “all customers” are only playing with what they can afford to lose, the scheme is primarily focused on the High Value (VIP) customers, who provide a “disproportionate financial value” to operators. The Commission feels that these players are at a “greater risk of gambling-related harm” due to a potential risk of them being encouraged to play more and more.

These regulations are designed to push operators away from a passive system,where the player is solely responsible for their own safety, and into a new, proactive, system, where the responsibility for safe gambling lies squarely with the operator.

For operators, the transition is much easier said than done.

Since the announcement of these changes, it’s clear that a number of operators haven’t been able to implement the processes required to proactively identify at-risk players. As such, we’ve seen operators hit with fines of up to £6m amid details of players losing over £1m without any checks on their financial wellbeing.

To avoid similar headlines, many operators have decided to implement a one-size-fits-all approach with regards to player management: once any player hits a particular financial threshold, their account is frozen until documentation supporting a player’s finances are provided. Although it solves the immediate regulatory challenge, this approach leads to such a poor customer experience that many platforms find High Value, low-risk customers leaving for new pastures while their documentation is processed.

So how can operators comply with new gambling regulations without putting significant revenue at risk? The answer is to look at transitioning away from that one-size-fits all approach to a player management strategy that delivers one-to-one communications that are uniquely relevant to each individual player’s circumstance. To do that efficiently, there are five dimensions that abilities that operators need to execute.

1. Look at players in their financial context

When it comes to offering one-to-one communication, it may sound obvious to say that we need to be dealing with every customer on his/her own merits. Not only does this provide a better experience for the user, but also, from an operator’s point of view, it ensures that we’re not treating players who have the financial means to support their play the same way as players who don’t. In other words, £500/week may be too much for player A but it may be fine for Player B, so managing them in the same way is not an efficient way to operate.

To be able to deliver experiences tailored to each individual, however, we need to ensure that everything we know about each user is aligned and stored in a single location. When data is siloed across a business, it’s nearly impossible to deliver relevant and compliant experiences at scale.

2. Identify at-risk players

Once we have an understanding of players’ financial context, we can start to make decisions on whether a customer’s history potentially flags them as being at risk. The Gambling Commission regulations state that operators should be able to demonstrate that they’ve done their best to support those players who are identified as potentially being at risk.

Therefore, operators need to be able to provide proof of all communications and interactions that they have had with a particular player. That could, for example, cover being able to demonstrate that a player viewed sensible gambling content on site or opened an email with relevant content.

From a commercial standpoint, data modeling and decisioning should be used to identify players as early as possible so that we’re not in the position of having to freeze user accounts for financial checks. By proactively measuring player activity, operators can ask for the necessary documents ahead of time and alter their marketing communications to encourage players to engage with less volatile games while the documentation is being processed.

3. Coordinate communications across all channels

When delivering one-to-one communication, it’s vital that marketing messages remain consistent wherever a customer is targeted. Not only does fragmentation of messages frustrate the customer, but, when it comes to the new regulations, operators also need to avoid the risk of providing support in one channel (over email, for example), while incentivising more play in another (such as advertisements on social media).

4. Operate in real time

The regulations state that, once a player is identified as potentially being at risk, “meaningful responsible gambling interactions” which allow players to withdraw their consent to further marketing should be sent “as soon as practicable.”

However, our internal analysis of the market shows that it typically takes operators around 24 hours to start support communications. This means that players are potentially open to receiving activation messaging which would be viewed dimly by the Gambling Commission.

Instead, we need to ensure that once a player is identified, all marketing messages across app, email and acquisition channels are instantly frozen or amended to show support for the player.

5. Privacy

We find that a lot of our gambling clients operate across multiple geographic regions, which adds another layer of complexity when it comes to communication with customers. Consumer expectations around privacy are sky high, and disparate (and ever changing) privacy laws make it very hard to implement data governance.

In this day and age, it is critically important to be able to store, manage and share consent state while using that information to control who and how you communicate with customers at a granular level.

How Customer Data Platforms help you deliver regulatory-compliant player experiences

Every operator wants to deliver more relevant experiences to their players and support regulatory compliance.

Delivering communications that are tailored to each users’ circumstances, however, requires the ability to access a complete view of every user in a single location and control how communications are delivered based on that data.

But with legacy architectures, data silos, and disperate user identifiers, delivering individual-level experiences can require hours of data cleansing and developer support. And even then the margin for error is high, and data can’t be activated in a timely manner.

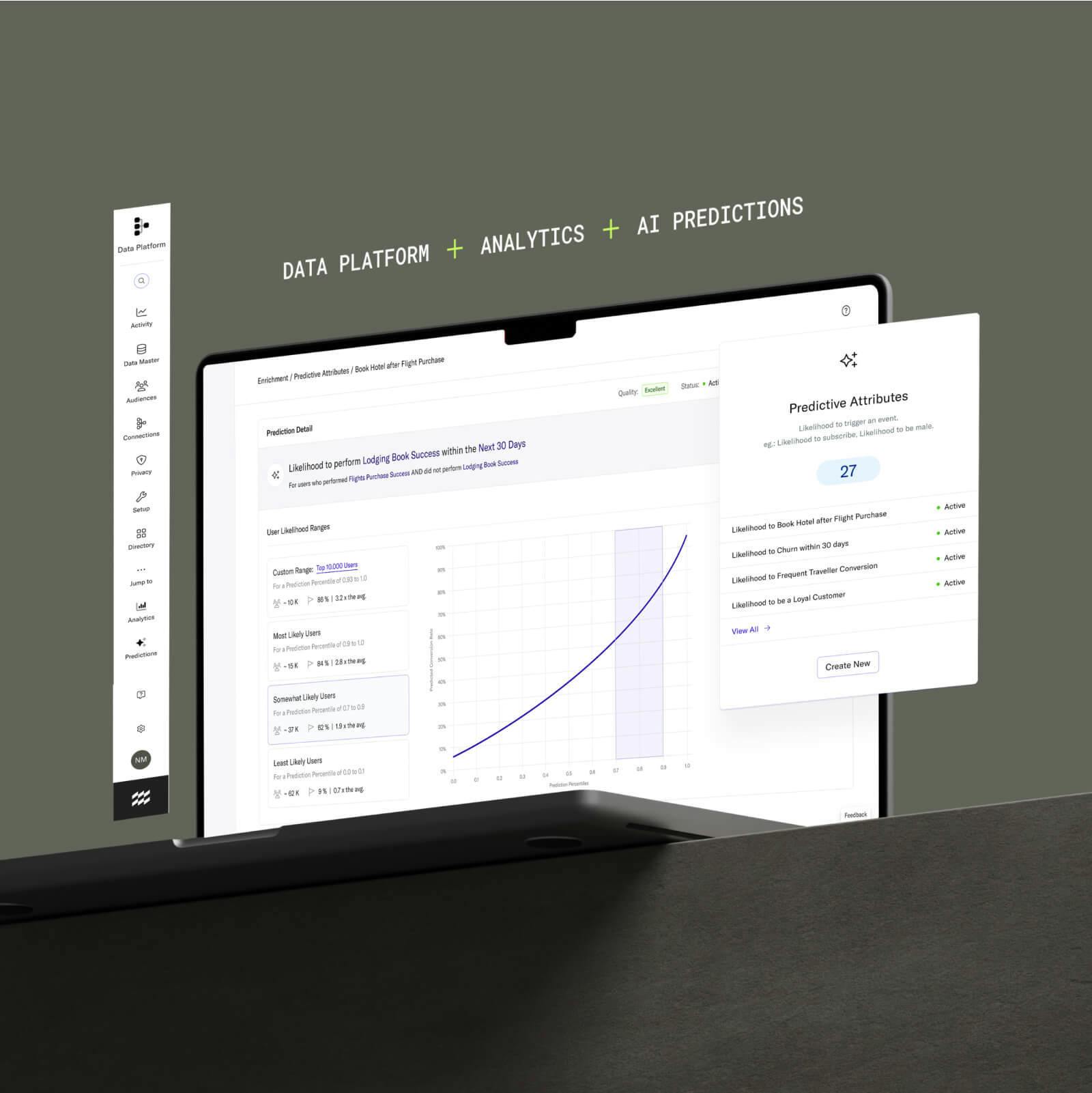

mParticle allows you to turn data chaos into order by bringing customer data from numerous sources (web, mobile, point of sale, server-side environments, cloud vendors, and more) into a single system. By unifying all this data to deterministic customer profiles and validating it for data quality, consistency, and completeness, mParticle enables your team to access high-quality data without ongoing engineering support.

Next, you can connect data to downstream messaging, analytics, advertising, and customer support tools via point-and-click integrations, controlling what data is forwarded with event and attribute-level filtering. Additionally, you can build player segments and connect them to the engagement and advertising tools of your choice without any engineering support.

With a central data infrastructure in place, you’re able to:

- Identify and segment at-risk players

- Prohibit at-risk players from being delivered experiences that promote additional playing

- Actively enroll at-risk players in support campaigns that match their situation

Furthermore, you’re able to differentiate players who have the means to support their play from those that don’t, and deliver messaging that is appropriate for each cohort.